Blog : Trap Doors in Penny Stocks

by Peter Leeds on December 30th, 2015

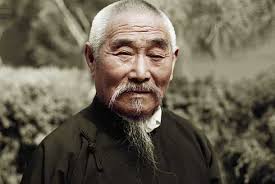

An ancient Chinese proverb says, "you eventually lose all you gamble with."

Some believe investing is a form of gambling, and with penny stocks it very often is. However, you and I both know that it is possible to come out on top, despite what the proverb might imply.

Even "the best laid plans" often have a way of turning South on you pretty quickly, and no amount of analysis and research can prepare you for Black Swan events.

Case in point, take a look at some of the events among a few of Peter's personal penny stock and small cap trades over the last few weeks.

- one corporation had the factory of one of their major suppliers catch fire and explode.

- another, a pharma company, suffered a death in their clinical trial, which destroyed the share price and put their entire FDA approval process in jeopardy.

- one was hit by a sudden and unexpected SEC investigation.

None of these events were expected by any analysts or shareholders. There was no way to anticipate such occurrences, which is why the shares were trading so much higher before the crash.

These negative sparks are also why investing in speculative penny stocks can be such a painful game, and should be reserved only for the risk tolerant.

However, even in the face of these "calamitous" events, there are things you should do to come out on top with your penny stock investments. Many of them are tactics which Peter applied, so that what could have been devastating simply becomes a collection of inconvenient frustrations.

- Peter only got involved with these penny stocks after an original fall from previous heights. This significantly reduces further downside, even when they take another hit.

- these stocks all have significant cash positions, usually greater in terms of cash per share than their actual share price.

- by position sizing, Peter ensures that only a slight part of his porfolio is invested in any one penny stock.

- understand selling lets up, it always does in penny stocks after the initial panick.

- understand stampede selling causing out-sized losses due to technical imbalances (sell as a group, and the shares fall well below their actual appropriate value).

- the longer term business model is sound, so patience should pay off and show a return to higher price levels.

- only invest in the first place, if you have a long-enough timeframe to wait out any obstacles and detrimental events (see below).

Think of any downside dip as more costly in terms of time than dollars. Assuming you get involved with companies that are not going to zero, you simply need to have the patience to allow an eventual recovery to wipe out the losses.

Understand that unexpected negative events will happen in penny stocks. You won't see them coming - that's why they are called "unexpected."

To invest well, keep your position sizes small with any one penny stock, so that no single massive event will wipe you out. Have enough of a time frame to wait out any major dips, and only get involved with companies which have massive cash positions and strong financial situations.

Think of their cash position like a buffer. It will insulate the shares from too much downside selling. For example, one of the penny stocks we mentioned above has nearly $8 in cash per share, despite trading at only $4.

This one is going higher, and soon. If you want to see it, along with Peter's explanation and analysis, just click here.

You are reading this old blog entry because we still like to reference it. :-)

Get Our Best Low-Priced Investments

- don't have the time?

- can't do all the work required?

- want selections from the authority?

For only $199 per year, we give you our best high-quality, low-priced stock picks. Along with a full team, Peter Leeds is the widely recognized authority on small stocks. Start making money from penny stocks right away.